Assorted links: Corporate Finance and Financial Markets Analysis

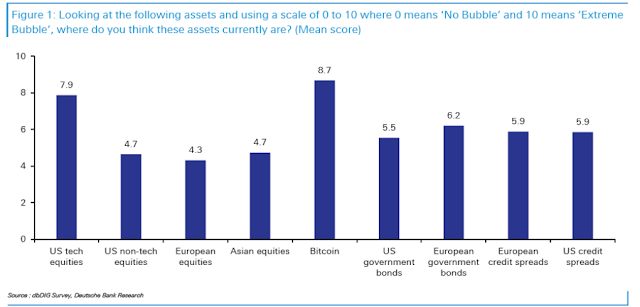

Where you think bubbles are… (asked of global market professionals)

Does regulation only bite the less profitable? Evidence from the too-big-to-fail reforms. Regulatory reforms following the financial crisis of 2007–08 created incentives for large global banks to lower their systemic importance. We establish that differences in profitability shape banks' response to these reforms. Indeed, profitability is key because it underpins banks' ability to generate capital and drives the opportunity cost of shrinking. Our analysis shows that only the less profitable banks lowered their systemic footprint relative to their equally unprofitable peers that were unaffected by the regulatory treatment. The more profitable banks, by contrast, continued to raise their systemic importance in sync with their untreated peers (BIS Working Papers).

Scenario-based cash planning in a crisis: Lessons for the next normal. Five best practices can ensure organizations are fully prepared for future challenges (McKinsey).

From fintechs to banking as a service: global trends banks cannot ignore (LSE Business Review).

Ensemble Active Management: The Blueprint for Rescuing Active Management (Enterprising Investor).

Finally, Cryptocurrencies are democratizing the financial world. Here's how

Source: WEF

You can follow me on Twitter: @jp_economics

Comentarios