Recommended articles: Finance

Some interesting articles about corporate finance and financial economics:

- Bracing for seven critical changes as fintech matures (McKinsey): The fintech sector is being shaped by shifting market conditions, new regulations, and changes in consumer demands and behaviors.

- Do Higher Capital Standards Always Reduce Bank Risk? The Impact of the Basel Leverage Ratio on the U.S. Triparty Repo Market (Working paper).

- A higher global risk premium and the fall in equilibrium real interest rates (VOX CEPR's Policy Portal): There is an increasing consensus that global ‘excess saving’ has contributed to a reduction in equilibrium real interest rates. This implies a decline in yields of all assets including, but not restricted to, government bond yields. This column argues that since the turn of the century, the global economy has also been characterised by a rise in the yields on quoted equity, a feature for which the standard excess saving story cannot easily account. A separate explanation is that an increase in the global risk premium has increased the wedge between risk-free interest rates and the real required return on risky investments.

- Reforming mutual funds: A proposal to improve financial market resilience (VOX CEPR's Policy Portal): A growing class of mutual funds – those that hold mostly illiquid assets – appear to be a potential source of systemic risk. This column discusses why, and argues that converting open-end mutual funds into exchange-traded funds could mitigate the problem. When markets are liquid, exchange-traded funds operate like open-end mutual funds; but should markets become illiquid, exchange-traded funds then operate like closed-end funds and face no run risk.

- Financial globalisation and monetary policy effectiveness (VOX CEPR's Policy Portal): In theory, financial globalisation has ambiguous effects on monetary policy. It may dampen effectiveness, but it may also amplify it through exchange rate valuation effects. This column shows evidence that the latter effect has dominated since the 1990s. Financial globalisation has increased the output effect of a tightening in monetary policy by as much as 25%. One implication is that monetary policy transmission mechanisms have changed, with the exchange rate channel gaining importance at the expense of the interest rate channel.

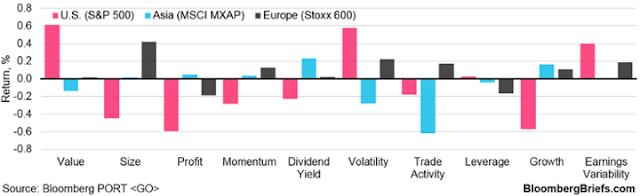

- Different Factors Driving Returns in Different Regions (The Big Picture):

Comentarios