Buscar este blog

Blog de Ciencia, Tecnología e Innovación en Economía, Finanzas y Políticas Públicas. Por Juan Pablo Zorrilla Salgador.

Entradas

Mostrando entradas de agosto, 2018

Recommended articles for the weekend

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

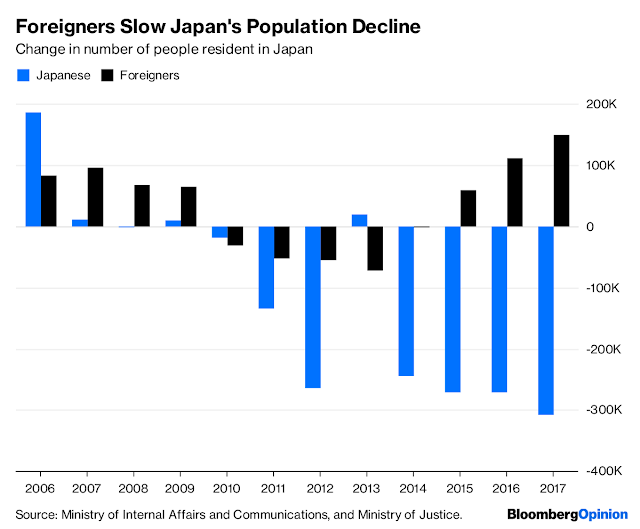

Gráfico: Decrece la población japonesa

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Lecturas recomendadas para la semana

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Recommended articles to read over the week

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Amazon es ahora el tercer servicio de suscripción de música más grande del mundo

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Los trabajadores eventuales con estudios universitarios finalizados han aumentado con el tiempo

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Datos del uso de las redes sociales en 2018

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Cuales son las redes sociales más populares entre los más jóvenes

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Los dispositivos más populares para ver Televisión por Internet

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Mapa que muestra dónde es legal e ilegal el aborto en el mundo

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Las mayores adquisiciones de empresas tecnológicas (1991-2018)

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Recommended articles: Finance, Analytics, Risk and FinTech.

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Artículos recomendados: innovación, ciberseguridad, criptomonedas y riesgo del cambio climático, entre otros

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Presidentes de los Estados Unidos y crecimiento del PIB

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

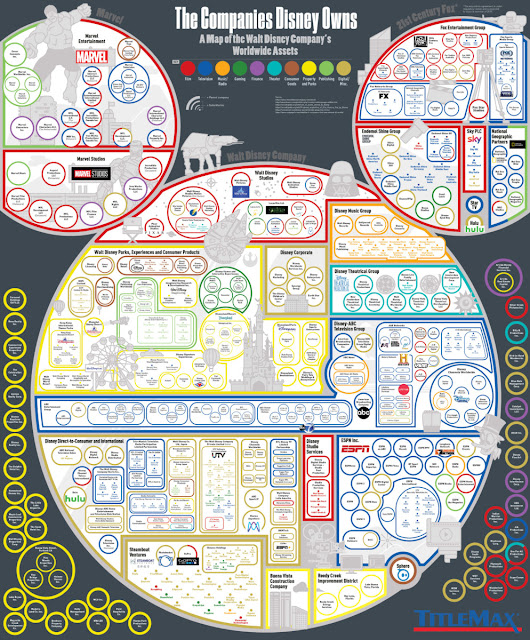

La guerra por las fusiones y adquisiciones: AT & T y Disney

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Ingresos de la industria musical al nivel global de 1999 al 2017

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Recommended articles: Technology and Risk

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

Artículos recomendados de la semana

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones

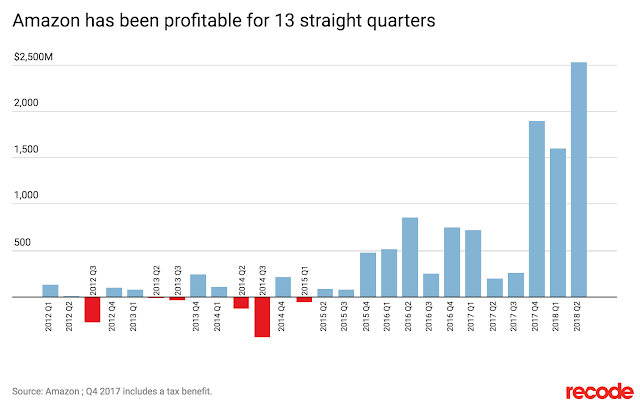

El Amazon que todos deberían temer nada tiene que ver con el comercio minorista

- Obtener enlace

- X

- Correo electrónico

- Otras aplicaciones